TORONTO, ONTARIO – April 24, 2023 – Grey Wolf Animal Health Corp. (TSX-V: WOLF)

(“Grey Wolf” or the “Company”), a Canadian diversified animal health company, today reported

financial results for the fourth quarter and year ended December 31, 2022.

“2022 was another successful year for Grey Wolf. We saw strong revenue growth in the quarter and the year driven by organic growth in both our Animal Health business unit and Pharmacy business unit. Our integrated sales and marketing strategy to both established brands and new product launches continues to increase our reach and frequency into clinics and supports our organic growth.” said Angela Cechetto, Chief Executive Officer.

“During the fourth quarter, we completed the qualifying transaction with Magen and commenced trading on the TSX-V. This is yet another transformational step in our journey as a company and positions us well to pursue future growth initiatives as we continue to build a diversified animal health company” added Ms. Cechetto.

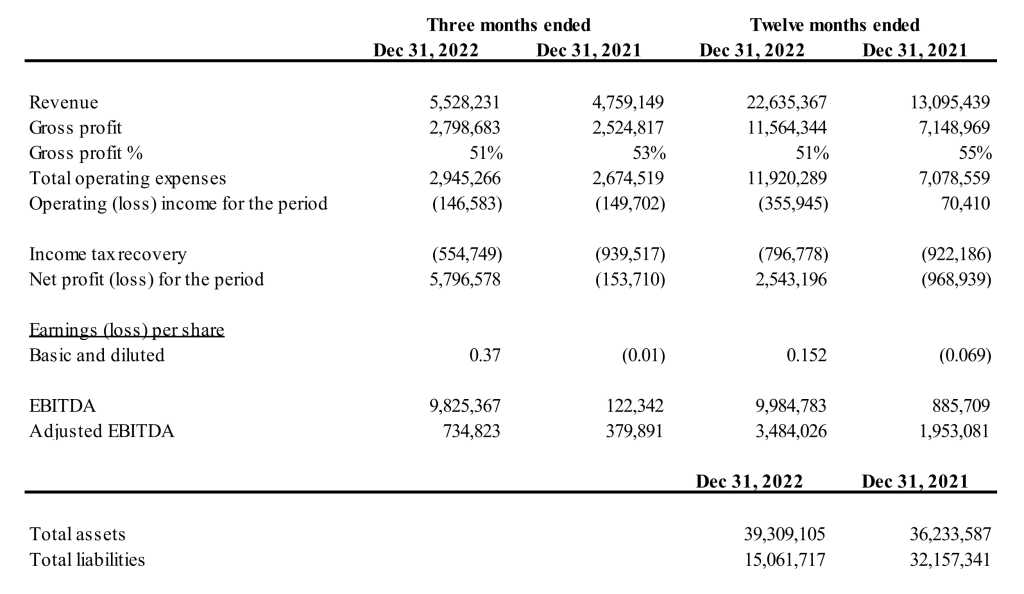

Revenue for the three- and twelve-month periods ended December 31, 2022, increased 16.2% to $5.5 million and 72.8% to $22.6 million, respectively, over the same periods in 2021. These increases were mainly due to organic revenue growth from the Animal Health business unit during 2022 as well as a full-year contribution from the Pharmacy business unit (versus fourmonths contribution in 2021).

Gross margins for the three- and twelve-month periods ended December 31, 2022, decreased to 51% compared to 53% and 55%, respectively, over the same periods in 2021. Gross margins were impacted by a full year contribution from the Pharmacy business unit and product mix in the Animal Health business unit. As a reflection of a trend throughout the global economy during 2022, cost of sales also increased due to (i) price increases paid for finished goods as suppliers of finished goods experienced increases to the prices of components, ingredients, and other inputs and (ii) increased shipping costs.

Total expenses for the three- and twelve-month periods ended December 31, 2022 increased 10.1% to $2.9 million and 68.4% to $11.9 million over the same periods in 2021. The increase is related to operational growth as well as the resumption of in-person sales and marketing activities that did not occur in 2021. Finally, there was also an increase in professional fees and outside services related to the Magen Transaction, completed in 2022, as compared to professional fees and outside services related to Grey Wolf’s financing activities and the Trutina Acquisition completed in 2021.

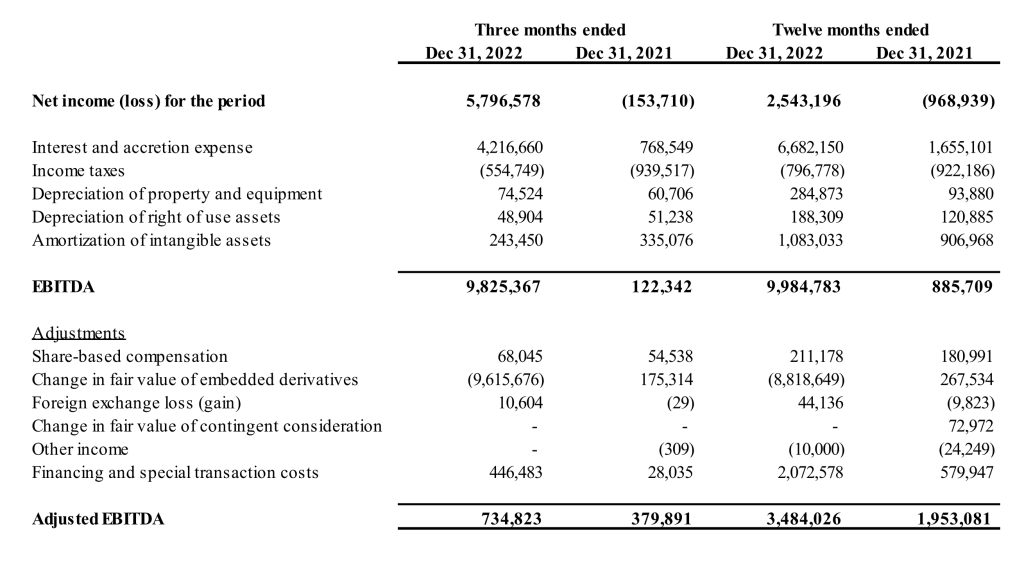

Adjusted EBITDA1 increased to $0.7 million in the fourth quarter 2022 versus $0.4 million in the prior year’s quarter. For the year Adjusted EBITDA1 increased 78.3% to $3.5 million from $2.0 million in 2021.

Cash and cash equivalents were $6.9 million at December 31, 2022 compared to $4.4 million in 2021. As at December 31, 2022, the Company had outstanding borrowings of $10.1 million, of which $1.05 million are current and $9.05 million are non-current. The Company’s debt bears fixed interest at a rate of 4.0% per annum on $10,000,000 and 10.0% per annum on the remaining $1,500,000 until September 2026.

The following table provides a summary of the differences between Grey Wolf’s consolidated IFRS and Non-IFRS financial measures, which are reconciled below:

Grey Wolf Animal Health Corp., headquartered in Toronto, Canada, is a diversified animal health company founded by a veterinarian to bring to market a broad portfolio of products that meets the unmet needs of veterinarians, clinics and pets. The Company’s strategy is to in-license, acquire or develop innovative prescription and non-prescription products for commercialization in the veterinarian channel in Canada. For additional information, please visit: www.greywolfah.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Certain information included in this press release contains forward-looking information with the meaning of applicable Canadian securities laws. This information includes statements concerning the Company’s objectives, its strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates, and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “would”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”, or similar expressions suggesting future outcomes or events or the negative thereof. Such forward-looking information reflects management’s beliefs and is based on information currently available. All forward-looking information in this press release is qualified by the following cautionary statements.

Forward-looking information necessarily involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond the Company’s control, affect the operations, performance and results of the Company and its subsidiaries, and cause actual results to differ materially from current expectations of estimated or anticipated events or results.

A more detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the Risk Factors section of Grey Wolf’s Management Discussion and Analysis for the twelve months ended December 31, 2022. The forward-looking information included in this press release is made as of the date hereof and should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof. Management undertakes no obligation, except as required by applicable law, to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise.