TORONTO, ONTARIO – November 23, 2023 – Grey Wolf Animal Health Corp. (TSX-V: WOLF) (“Grey Wolf” or the “Company”), a Canadian diversified animal health company, today announced financial results for the quarter and nine months ended September 30, 2023.

“The third quarter of 2023 was another solid quarter for Grey Wolf. We saw total revenue grow by 12.4% to $6.5 million driven by organic growth within our product portfolio. On a year-to-date basis, gross margins have remained consistent compared to the prior year. In addition, Adjusted EBITDA1 increased by $0.2 million for the quarter and nine months largely as a result of improved operating income.” said Angela Cechetto, Chief Executive Officer. “Furthermore, revenue, gross profit, Adjusted EBITDA1 and cash have all increased year over year for the third quarter and nine months ending September 30, 2023. Additionally, we continued to pay down our debt and are poised for future growth.”

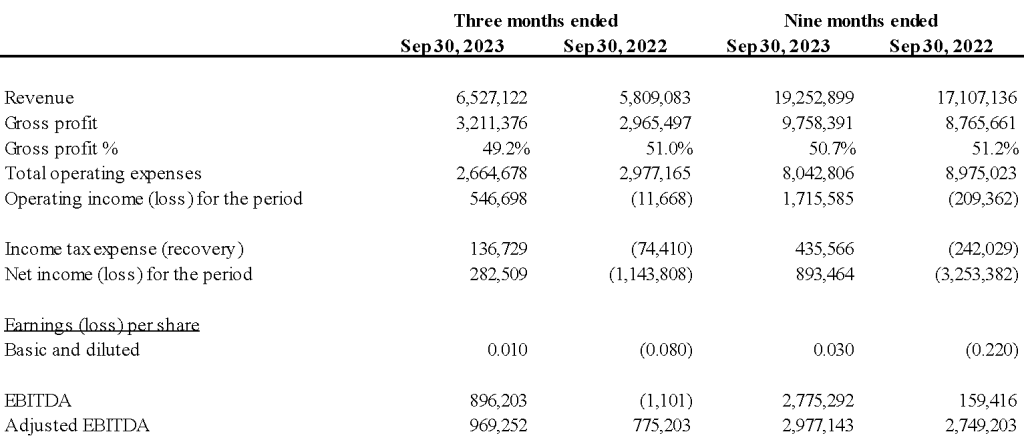

Revenue for the three- and nine-month period ended September 30, 2023, increased 12.4% to $6.5 million and 12.5% to $19.3 million, respectively, over the same period in 2022. This increase was due to organic revenue growth in both the Animal Health and Pharmacy business units.

Gross margins for the three- and nine-month period ended September 30, 2023, decreased slightly to 49.2% compared to 51.0% and 50.7% compared to 51.2%, respectively, over the same period in 2022. Gross margins were impacted by reduced margins in the Pharmacy business and product mix in the Animal Health business.

Total expenses for the three- and nine-month period ended September 30, 2023, decreased 10.5% to $2.7 million and 10.4% to $8.0 million, respectively, over the same period in 2022. The decrease in total expenses was largely related to costs associated with the Qualifying Transaction during the same periods in 2022 offset by costs noted below. During the three-month period, there was an increase in salary, bonus, and benefits related to operational growth as compared to the same period in 2022. Travel, meals, and business expenses increased in 2023 as the sales and marketing team increased attendance at conventions, trade shows and customer visits. Finally, there was an increase in professional fees and outside services related to corporate costs as the company now operates as a public entity.

Adjusted EBITDA1 for the three- and nine-months ended September 30, 2023, increased by $0.2 million to $1.0 million and $0.2 million to $3.0 million, respectively, when compared to the corresponding period in 2022.

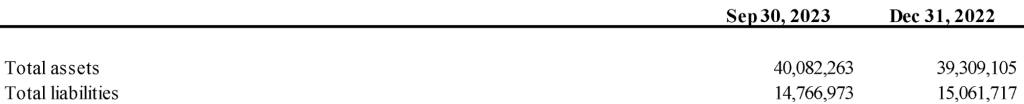

Cash and cash equivalents were $8.0 million as at September 30, 2023 compared to $6.9 million at December 31, 2022. The Company generated cash from operations of $2.1 million in the first nine months of 2023 primarily as a result of revenue growth in both the Animal Health and Pharmacy businesses. This was offset by the use of $0.4 million of the Company’s cash resources from changes in working capital and the repayment of borrowings of $0.7 million. As at September 30, 2023, the Company had outstanding borrowings of $9.4 million, of which $1.1 million are current and $8.3 million are non-current. The Company’s debt is a fixed rate term loan with an average interest rate of 4.7% until September 2026.

Grey Wolf’s financial statements and accompanying Management Discussion and Analysis for the three- and nine-months ended September 30, 2023 are available under the Company’s profile on www.sedar.com.

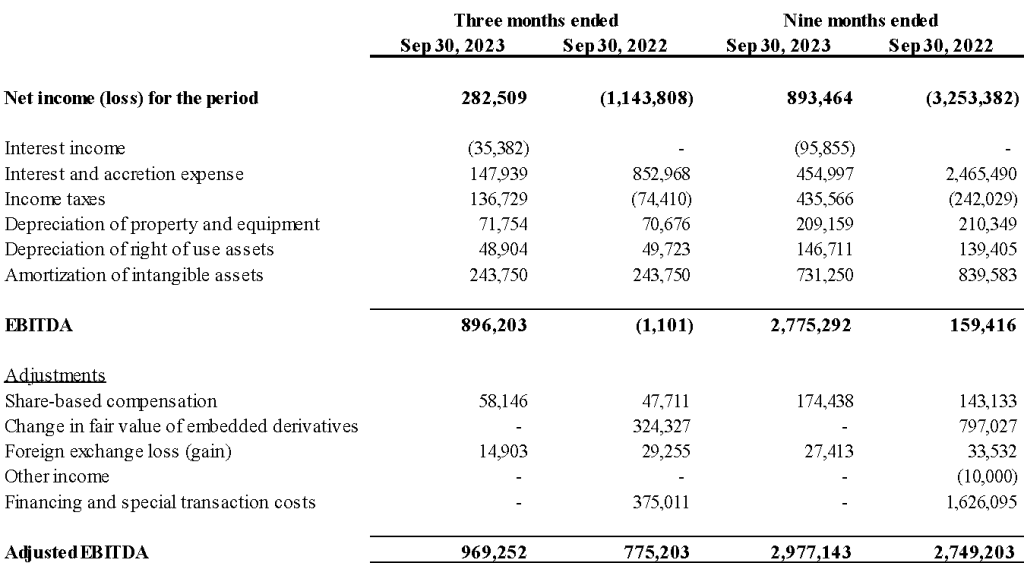

Management uses both IFRS and Non-IFRS Measures to assess the financial and operating performance of the Company’s operations. These Non-IFRS Measures are not recognized measures under IFRS, do not have a standardized meaning under IFRS and are unlikely to be comparable to similar measures presented by other companies. The Non-IFRS Measures referenced in this press release includes Adjusted EBITDA. The Company defines Adjusted EBITDA as earnings before financing and special transaction costs (including, for greater certainty, fees related to the Qualifying Transaction), interest income, interest and accretion expenses, income taxes, depreciation of property and equipment, depreciation of right of use assets, amortization of intangible assets, share-based compensation, change in fair value of embedded derivatives, foreign exchange gains or losses, and other income. The Company considers Adjusted EBITDA as an additional metric in assessing business performance and an important measure of operating performance and cash flow, providing useful information to help analyze and compare profitability between companies for investors and analysts.

The following table provides a summary of the differences between Grey Wolf’s consolidated IFRS and Non-IFRS financial measures, which are reconciled below:

Grey Wolf Animal Health Corp., headquartered in Toronto, Canada, is a diversified animal health company founded by a veterinarian to bring to market a broad portfolio of products that meets the unmet needs of veterinarians, clinics and pets. The Company’s strategy is to in-license, acquire or develop innovative prescription and non-prescription products for commercialization in the veterinarian channel in Canada. For additional information, please visit: www.greywolfah.com.

For further information, please contact:

Angela Cechetto

Chief Executive Officer

E-mail: investors@greywolfah.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Certain information included in this press release contains forward-looking information with the meaning of applicable Canadian securities laws. This information includes statements concerning the Company’s objectives, its strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates, and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “would”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”, or similar expressions suggesting future outcomes or events or the negative thereof. Such forward-looking information reflects management’s beliefs and is based on information currently available. All forward-looking information in this press release is qualified by the following cautionary statements.

Forward-looking information necessarily involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond the Company’s control, affect the operations, performance and results of the Company and its subsidiaries, and cause actual results to differ materially from current expectations of estimated or anticipated events or results.

A more detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the Risk Factors section of Grey Wolf’s Management Discussion and Analysis for the three and nine months ended September 30, 2023. The forward-looking information included in this press release is made as of the date hereof and should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof. Management undertakes no obligation, except as required by applicable law, to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |